Is There Sales Tax On Labor In Pennsylvania . While pennsylvania's sales tax generally applies to most transactions, certain items have. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web when is labor subject to sales tax? Web are services subject to sales tax? Web what transactions are generally subject to sales tax in pennsylvania? Web many services are subject to pennsylvania’s 6% sales tax rate: In the state of pennsylvania, sales tax is legally required. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. The sales tax regulation concerning employment agency services is found in the pa code. Web the pennsylvania sales tax rate is 6 percent. Web when is labor subject to sales tax? Is all service work on an item that was taxable at the time of installation, taxable when. Adjustment, collection, or credit reporting.

from www.chegg.com

The sales tax regulation concerning employment agency services is found in the pa code. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web are services subject to sales tax? In the state of pennsylvania, sales tax is legally required. Web when is labor subject to sales tax? Web many services are subject to pennsylvania’s 6% sales tax rate: Web the pennsylvania sales tax rate is 6 percent. Web what transactions are generally subject to sales tax in pennsylvania? Is all service work on an item that was taxable at the time of installation, taxable when. Web when is labor subject to sales tax?

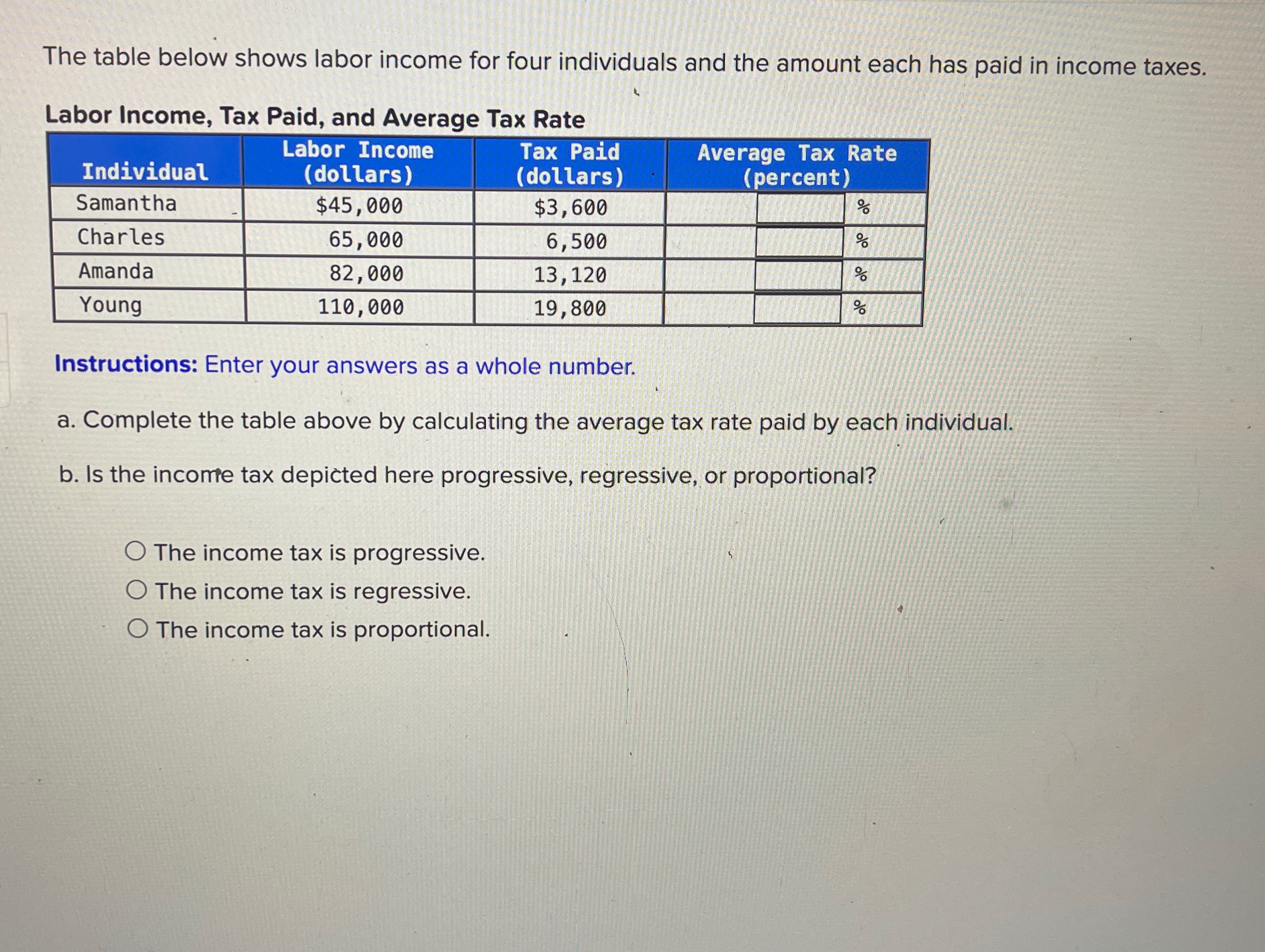

Solved The table below shows labor for four

Is There Sales Tax On Labor In Pennsylvania Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web when is labor subject to sales tax? Web the pennsylvania sales tax rate is 6 percent. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web when is labor subject to sales tax? While pennsylvania's sales tax generally applies to most transactions, certain items have. In the state of pennsylvania, sales tax is legally required. The sales tax regulation concerning employment agency services is found in the pa code. Web many services are subject to pennsylvania’s 6% sales tax rate: Adjustment, collection, or credit reporting. Is all service work on an item that was taxable at the time of installation, taxable when. Web are services subject to sales tax? Web what transactions are generally subject to sales tax in pennsylvania?

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Pa Is There Sales Tax On Labor In Pennsylvania Web many services are subject to pennsylvania’s 6% sales tax rate: In the state of pennsylvania, sales tax is legally required. Adjustment, collection, or credit reporting. Web when is labor subject to sales tax? While pennsylvania's sales tax generally applies to most transactions, certain items have. The sales tax regulation concerning employment agency services is found in the pa code.. Is There Sales Tax On Labor In Pennsylvania.

From www.bls.gov

Business Employment Dynamics in Pennsylvania — First Quarter 2022 Mid Is There Sales Tax On Labor In Pennsylvania Is all service work on an item that was taxable at the time of installation, taxable when. Web the pennsylvania sales tax rate is 6 percent. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web when is labor subject to sales tax? By law, a 1 percent local tax is added to. Is There Sales Tax On Labor In Pennsylvania.

From www.salesandusetax.com

Pennsylvania Sales Tax Compliance Agile Consulting Is There Sales Tax On Labor In Pennsylvania In the state of pennsylvania, sales tax is legally required. While pennsylvania's sales tax generally applies to most transactions, certain items have. Adjustment, collection, or credit reporting. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web the pennsylvania sales tax rate is 6 percent. Is all service work on an item that. Is There Sales Tax On Labor In Pennsylvania.

From templates.esad.edu.br

Printable Sales Tax Chart Is There Sales Tax On Labor In Pennsylvania The sales tax regulation concerning employment agency services is found in the pa code. Web many services are subject to pennsylvania’s 6% sales tax rate: By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web when is labor subject to sales tax? Web what transactions are generally subject to sales tax in pennsylvania?. Is There Sales Tax On Labor In Pennsylvania.

From careerindieauthor.com

Do I Need A Business License to Write In Pennsylvania? Career Indie Is There Sales Tax On Labor In Pennsylvania Adjustment, collection, or credit reporting. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web when is labor subject to sales tax? By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web are services subject to sales tax? Web what transactions are generally subject to sales. Is There Sales Tax On Labor In Pennsylvania.

From www.reddit.com

Sales tax in the United States r/MapPorn Is There Sales Tax On Labor In Pennsylvania By law, a 1 percent local tax is added to purchases made in allegheny county, and. Is all service work on an item that was taxable at the time of installation, taxable when. While pennsylvania's sales tax generally applies to most transactions, certain items have. Web are services subject to sales tax? Web what transactions are generally subject to sales. Is There Sales Tax On Labor In Pennsylvania.

From privateauto.com

How Much are Used Car Sales Taxes in Pennsylvania? Is There Sales Tax On Labor In Pennsylvania Adjustment, collection, or credit reporting. Web when is labor subject to sales tax? In the state of pennsylvania, sales tax is legally required. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web when is labor subject to sales tax? Web many services are subject to pennsylvania’s 6% sales tax rate: Is all. Is There Sales Tax On Labor In Pennsylvania.

From taxfoundation.org

State Corporate Tax Rates and Brackets for 2020 Is There Sales Tax On Labor In Pennsylvania Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web what transactions are generally subject to sales tax in pennsylvania? Web the pennsylvania sales tax rate is 6 percent. Web when is labor subject to sales tax? By law, a 1 percent local tax is added to purchases made in allegheny county, and.. Is There Sales Tax On Labor In Pennsylvania.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Pennsylvania Is There Sales Tax On Labor In Pennsylvania Web when is labor subject to sales tax? Adjustment, collection, or credit reporting. Web when is labor subject to sales tax? By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web many services are subject to pennsylvania’s 6% sales tax rate: In the state of pennsylvania, sales tax is legally required. Web are. Is There Sales Tax On Labor In Pennsylvania.

From cs.thomsonreuters.com

Pennsylvania How to determine which local taxes should calculate Is There Sales Tax On Labor In Pennsylvania Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Is all service work on an item that was taxable at the time of installation, taxable when. Web what transactions are generally subject to sales tax in pennsylvania? Web many services are subject to pennsylvania’s 6% sales tax rate: The sales tax regulation concerning. Is There Sales Tax On Labor In Pennsylvania.

From www.chegg.com

Solved The table below shows labor for four Is There Sales Tax On Labor In Pennsylvania Is all service work on an item that was taxable at the time of installation, taxable when. Web many services are subject to pennsylvania’s 6% sales tax rate: The sales tax regulation concerning employment agency services is found in the pa code. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Adjustment, collection,. Is There Sales Tax On Labor In Pennsylvania.

From www.strashny.com

Pennsylvania Cuts Corporate Net Tax Rate Laura Strashny Is There Sales Tax On Labor In Pennsylvania Is all service work on an item that was taxable at the time of installation, taxable when. Web the pennsylvania sales tax rate is 6 percent. Web many services are subject to pennsylvania’s 6% sales tax rate: While pennsylvania's sales tax generally applies to most transactions, certain items have. By law, a 1 percent local tax is added to purchases. Is There Sales Tax On Labor In Pennsylvania.

From itep.org

Pennsylvania Who Pays? 6th Edition ITEP Is There Sales Tax On Labor In Pennsylvania Web the pennsylvania sales tax rate is 6 percent. The sales tax regulation concerning employment agency services is found in the pa code. In the state of pennsylvania, sales tax is legally required. While pennsylvania's sales tax generally applies to most transactions, certain items have. Web when is labor subject to sales tax? Adjustment, collection, or credit reporting. By law,. Is There Sales Tax On Labor In Pennsylvania.

From studylib.net

Pennsylvania Sales Tax Information Is There Sales Tax On Labor In Pennsylvania In the state of pennsylvania, sales tax is legally required. Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web the pennsylvania sales tax rate is 6 percent. Web when is labor subject to sales tax? Web many services are subject to pennsylvania’s 6% sales tax rate: Web when is labor subject to. Is There Sales Tax On Labor In Pennsylvania.

From infogram.com

Pennsylvania's historical sales and tax rates Infogram Is There Sales Tax On Labor In Pennsylvania Web when is labor subject to sales tax? Web the pennsylvania sales tax rate is 6 percent. By law, a 1 percent local tax is added to purchases made in allegheny county, and. Web what transactions are generally subject to sales tax in pennsylvania? Web when is labor subject to sales tax? While pennsylvania's sales tax generally applies to most. Is There Sales Tax On Labor In Pennsylvania.

From itep.org

Pennsylvania Who Pays? 7th Edition ITEP Is There Sales Tax On Labor In Pennsylvania Is all service work on an item that was taxable at the time of installation, taxable when. The sales tax regulation concerning employment agency services is found in the pa code. Web are services subject to sales tax? Fees for labor are taxed when the labor is expended on a taxable item i.e., repairs. Web the pennsylvania sales tax rate. Is There Sales Tax On Labor In Pennsylvania.

From renebdorothy.pages.dev

Pa Sales And Use Tax Due Dates 2024 Jessy Imojean Is There Sales Tax On Labor In Pennsylvania While pennsylvania's sales tax generally applies to most transactions, certain items have. Is all service work on an item that was taxable at the time of installation, taxable when. Web what transactions are generally subject to sales tax in pennsylvania? Web the pennsylvania sales tax rate is 6 percent. In the state of pennsylvania, sales tax is legally required. Web. Is There Sales Tax On Labor In Pennsylvania.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Pa State Sales Tax License Is There Sales Tax On Labor In Pennsylvania Web the pennsylvania sales tax rate is 6 percent. Is all service work on an item that was taxable at the time of installation, taxable when. Web when is labor subject to sales tax? The sales tax regulation concerning employment agency services is found in the pa code. By law, a 1 percent local tax is added to purchases made. Is There Sales Tax On Labor In Pennsylvania.